- …

- …

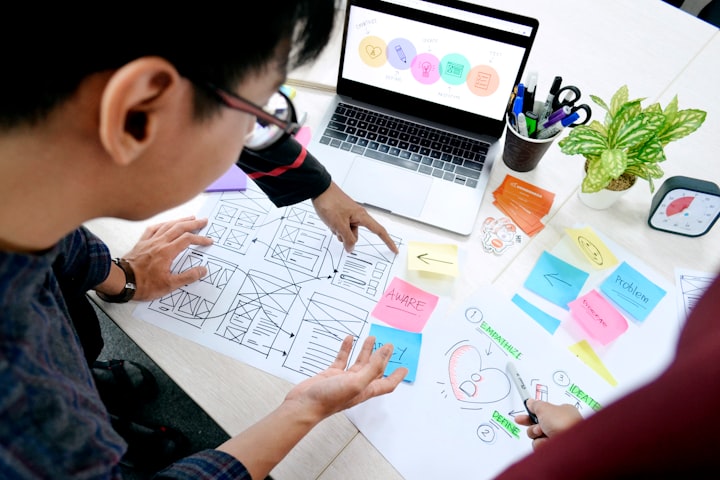

Experience Design and Strategy

We drive competitive advantage and innovation by helping our clients uncover hidden customer needs

Human-Centered Journey Mapping

At its core, a journey map is a visual storyboard that helps you understand moments that matter to people, in context. It's a powerful tool that can help you identify friction, pain points, and opportunity to create impactful solutions.

"Problem solvers love to problem solve. Thank goodness for energy like yours!"

-Carolina L. Chief Marketing Officer

Our Guiding Principles

Indepedent Perspective

You need someone who will look critically at your assumptions - about your product, your audience and yourself - and help you see them from afar. We're experts at what we like to call "making bad news feel like good news." Nothing soft-pedaled: just honest, open and cogent feedback - that you can turn into an actionable strategy.

Time-Tested Expertise

We’ve been at this for over 20 years, and we’ve helped 100s of clients – from small, local businesses and artists to Fortune 50 companies – connect with their audiences in truly extraordinary ways. We'll bring our experience in a variety of industries to bear on your particular challenges in a thought-provoking way.

Collaborative Design

We won’t just give you recommendations – we’ll actually teach you how to develop research & experience design skills, and implement our methods, within your own practice, so that you can continue to thrive after the projects end.

Of course, we'd like to keep working with you, too.

Selected Services

We help you create a more delightful, impactful, and fulfilling experience for your audience

Visualize Your Product Strategy, Align with Your Audience's Needs

- Build better products with a sustainable competitive advantage by focusing on real, validated, and measureable customer needs.

- Know which features are highest-value - to your customers, and your business - instantly.

- Gain a deeper understanding of your customer experience.

- Develop a high-impact, shareable, and collaborative visual representation of your how your customers conceive of and approach your product

- Priortize your research, product development and product strategy

Inform Development and Launch Decisions with Deeply-Insightful Research

- Save time and money by partnering with Chamjari to design and deploy your UX research

- Shorten development cycles by delivering insights exactly when you need them.

- Access our team of UX Research Professionals who are familiar with a wide variety of formative and summarive research techniques and best practices.

- Focus on your core competencies while leaving the research to us.

Quickly Validate Product Ideas

- Build better products with a deeper understanding of your users and their contexts of use

- Identify which tasks need to be accomplished, and the stakeholders involved.

- Model the structure of the experience.

- Develop an interaction design to bind the concept and design together

- Add Prototyping to create a rich, interactive artifacts that can be used in customer research.

Quickly Validate Product Ideas

- Get early customer feedback before you invest in building it and save time while reducing development risk

- Conduct market research, favorability testing and usability testing with real customers, and refine your product experience.

- Leverage our experience designing digital experiences for Fortune 500 companies

- Rest assured that your final design and implementation are as close to perfect as possible.

- Save money on implementation with your chosen development partner by providing them with a working prototype, richly-documented and responsively designed.

Let Us Help You To Plan Your Approach

Comparing services across different research, design, and consulting agencies can be difficult. RFPs don't always give you useful information. For clients who aren't quite sure yet where to start - research, UX architecture or development - we can help you plan out your approach to make the best use of your budget and internal resources.

A single-day cooperative planning session led by one of our most experienced consultants, the Roadmapping Session will provide you with a comprehensive planning document and scope definition that you can use to move forward with us, or any combination of partners you may choose.

Our Clients

We guide leading Automotive, Entertainment, Healthcare, Financial Services, and Consumer companies through Customer Research and Design Strategy, so they can build products and experiences that are enjoyed by hundreds of millions of people.

Every. Day.

We're excited to work with you!

Let's get started with a few questions...

© Copyright 2011-2023, Chamjari Interactive, Inc. | Terms & Conditions | Privacy Policy | Cookie Policy | Client Login